It's no secret that saving on utilities can mean immense profit for restaurant groups. However, energy prices have soared from California to Connecticut due to demand and the ongoing Russian and Ukraine Conflict. As a result, restaurant groups have been hit with a double whammy between food cost inflation and rising utility costs.

About 80 percent of electricity and 100 percent of natural gas are consumed by refrigeration, cooking, HVAC, and water heating, with refrigeration and cooking leading in both categories. Regular maintenance of electrical system must be done to improve your building’s energy efficiency.

According to a recent National Restaurant Association survey, food and labor costs are a restaurant's two most important line items, accounting for approximately 33 cents of every dollar in sales. Other expenses — such as utilities, occupancy, supplies, general/administrative, and repairs/maintenance — represent about 29% of sales. A substantial majority of operators say food, labor, and energy/utility costs are currently significant challenges for their restaurants.

- 92% of operators say food costs are a significant challenge.

- 89% of operators say labor costs are a considerable challenge.

- 50% of operators expect to make less profit in 2023.

"In this kind of economic environment, typical operators don't have much margin for error. With significant input costs escalating, they can make changes to align with local consumer demand while realigning operations for longer-term growth."

What used to be considered fixed costs are no longer. Instead, month-to-month increases are hitting the bottom line. While we are no expert in reducing your utility bill (check out this QSR article for helpful tips or this article from McDonald Paper), we can advise on tracking and being mindful of increases in your general ledger.

At Tablespoon, our mission is to help restaurant owners grow their businesses faster and more effectively. This happens on both sides of our business, selling and implementing Sage Intacct accounting software and providing outsourced accounting to restaurant groups. As a general practice, we advise all our restaurant groups to implement alerts and set up reports to track the items that matter the most. It's simple. The sooner you know about an issue, the sooner you can react. Whether it is an increase in utilities, food costs, low inventory, etc., your reaction time will determine how significant the impact on your business will be.

How Sage Intacct Alerts Work

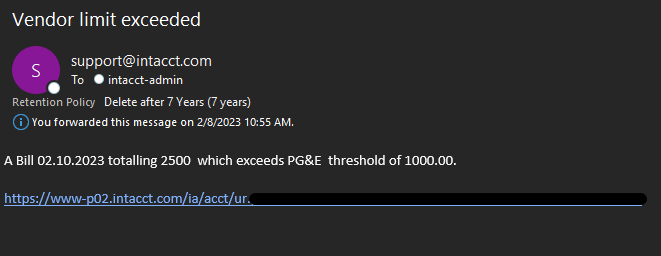

In Sage Intacct, you can set up alerts that will notify you whenever a significant event occurs. At Tablespoon, we'll work with you to define the events and parameters that trigger the alert and who will receive an email notification. Below is an example of what an alert looks like.

Reporting What Matters

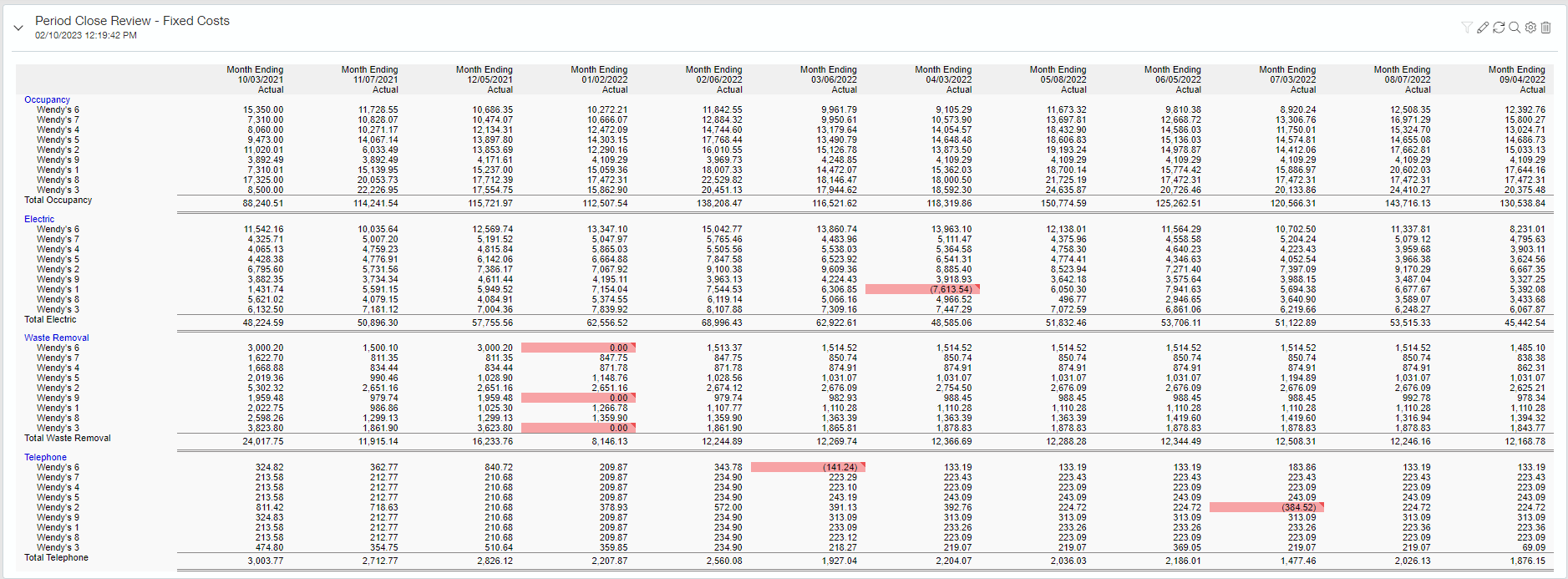

In addition to the Sage Intacct alerts, you can set up reports that deliver the information you want to see. Here's an example of what a report in Sage Intacct looks like:

- Alerts and general ledger mindfulness can also be applied to other expenses in your business, such as:

- Waste disposal, especially in California, has seen significant increases and fines for non-recyclables.

- Credit card tips

Restaurant operating and food costs – the average price of food in the United States increased 10.4% in the 12 months ended December after posting an annual increase of 10.6% in November, according to the latest inflation data published Jan. 12, 2023, by the U.S. Labor Department's Bureau of Labor Statistics (BLS). Fluctuation in costs can significantly impact your profits and bottom-line. Get the real-time reporting and alerts you need to stay on top of your restaurant groups/brands' costs. Contact us if you want to learn more about how Tablespoon can help you track what's important to you.